As the year winds down, one lesson stands out from building payment products across APAC. Most strategies don’t fail because they’re wrong. They fail because commercialisation is treated as a launch event, not a repeatable capability.

The deck is usually solid. Clear vision. Confident numbers. Ambitious timelines.

Reality starts after go-live.

In APAC, commercialisation is less about announcing features and more about making them work reliably across markets, partners, and use cases. Scale doesn’t come from ideas alone. It comes from execution that can be repeated without drama.

A few patterns I’ve seen consistently:

– Execution beats sophistication.

– Products scale when sales teams can explain them simply, partners can integrate them predictably, and operations can support them without custom fixes.

– Local nuance matters more than central playbooks.

– Regulation, customer behavior, and partner incentives vary sharply across the region. Platforms that win design for flexibility, not uniformity.

– Commercialization is a system, not a handoff.

Strong teams stay close to customers and partners well after launch, refining pricing, onboarding, and support as usage grows. This is also why newer conversations around digital assets or blockchain often feel overcomplicated.

The commercial use cases are familiar:

– Card payments, sometimes funded by stablecoins

– Faster and more competitive cross-border settlement

– Loyalty and stored value in new form factors

The real challenge isn’t the technology, it’s whether teams can sell, integrate, operate, and scale these capabilities responsibly, within regulation and real customer workflows.

Platforms that succeed treat commercialization as a muscle they continuously train. They invest in clear APIs, strong partner tooling, disciplined rollout, and fast feedback loops.

In payments, being first rarely wins. Being ready to scale repeatedly does.

As we look ahead, I’m less interested in the next big strategy deck and more focused on building execution muscle that compounds over time. That’s where durable advantage is created.

Category: Uncategorized

-

Commercialisation Is a Muscle, Not a Deck

-

Crypto-Native Loyalty: Letting Customers Spend Points Across Borders and at POS

For years, banks have been telling customers that rewards points are “as good as cash.”

In reality, they’re not.Points are locked inside catalogues, restricted by geography, and often expire before the customer can redeem anything meaningful. Cross-border travel, multi-country lives, and global e-commerce have exposed how outdated most loyalty programs really are.

Now imagine a different reality:

- Your customer earns points in Singapore.

- Converts them into a regulated, tokenized asset.

- Spends them instantly at a POS terminal in Tokyo, or online with a merchant in London.

- No clunky catalogues, no opaque FX, no “please allow 7–10 working days.”

That’s the promise of crypto-based loyalty programs for banks – not meme coins and speculation, but tokenized valuethat’s programmable, portable, and usable at the point of sale.

Let’s break down what this could look like.

What’s broken in today’s bank loyalty programs

Most bank loyalty systems were designed for a very different era:

- Closed and fragmented

- Points are locked to one bank, one geography, one catalogue.

- Cross-border redemption is either impossible or painfully manual.

- Poor real-time utility

- Customers can’t easily use points “in the moment” at POS.

- Redemption journeys are separate from the payment flow.

- Hidden economics

- Breakage is high, but so is operational cost and partner friction.

- FX, settlement, and reporting across partners is messy and slow.

- Customer frustration

- Complicated rules, blackout dates, minimum redemption thresholds.

- The perceived value of points is much lower than the cost to the bank.

In short: traditional points are trapped value. Tokenization is a way to unlock and orchestrate that value.

What do we mean by “crypto-based” loyalty?

Forget speculative coins. Think regulated, bank-led digital tokens:

- Each loyalty point (or bundle of points) is represented as a token on a controlled ledger (which could be a permissioned blockchain or tokenized ledger managed by the bank / consortium).

- Tokens can be:

- Earned from banking activity (spend, bill payments, product usage).

- Converted from existing points into token form.

- Redeemed or spent at POS or online, just like currency, within rules set by the bank.

Depending on regulation and design, these tokens might be:

- A closed-loop utility token (usable only with participating merchants & partners).

- Or a stablecoin-like instrument pegged to fiat value (e.g., 1 token = 1 unit of local currency equivalent), with clear AML/KYC controls.

The key shift: points become programmable value that can move across countries, partners, and channels in a standardized way.

How cross-border and POS use cases come to life

Here’s how a crypto-native loyalty system could work in practice.

1. Cross-border earn & burn

- Customer spends on a bank card in Country A.

- Earns loyalty tokens, visible in the bank’s app in near real time.

- While travelling in Country B, the customer:

- Pays at a partner merchant’s POS.

- Chooses “Pay with Tokens” or “Pay with Tokens + Card” in the payment flow.

- The system:

- Converts token value to local fiat equivalent using agreed FX logic.

- Settles with the merchant in local currency.

- Updates token balance instantly.

No catalogue, no vouchers, no “redeem miles for shopping” hacks. Just earn here, use there.

2. Pay-with-points at POS

At POS, the bank can expose token-based loyalty as another tender type:

- The terminal or online checkout queries the bank’s loyalty/token service.

- Customer sees options:

- Pay fully with tokens

- Part-pay with tokens + card

- Or keep tokens for later

- A simple UX (“Use 5,000 points to save $20?”) but backed by a token transfer on the bank’s ledger.

This lets banks move from “earn and forget” to real-time, in-journey rewards.

3. Global partner ecosystem

Because tokens sit on an interoperable ledger, partner onboarding becomes easier:

- Airlines, hotels, marketplaces, and retail chains can all plug into the same token rails.

- Banks can support:

- Instant point swaps between brands

- Joint promotions powered by shared token pools

- Multi-country campaigns without building 10 different catalogues

The more partners join, the stronger the network effect.

Why banks should care

This isn’t just a shiny tech upgrade. It drives real business value:

- Deeper engagement & higher spend

- Real-time, usable value at POS encourages more card usage and product adoption.

- Cross-border usability makes your card the “top of wallet” when customers travel.

- Better economics & lower breakage risk

- Tokenization improves tracking, pricing, and forecasting of loyalty liabilities.

- Programmability allows smart rules: dynamic earn rates, expiry, and partner-funded rewards.

- Interoperability instead of one-off integrations

- One token standard can support many partners and markets.

- This reduces long-term integration and ops costs compared to bespoke catalogue builds.

- New revenue streams

- Partner onboarding fees, token float income (where compliant), data & insights monetization.

- Premium services for high-value customers (e.g., instant FX-free redemption, curated partner access).

- Strategic positioning for the “programmable money” era

- CBDCs, stablecoins, and tokenized deposits are coming.

- A token-based loyalty layer is a safe way for banks to learn, experiment, and build capabilities without betting the core balance sheet.

Design choices that matter

To make this real (and not just a slide in a strategy deck), banks need to get a few things right:

- Regulation & compliance first

- Work closely with regulators on token classification, AML/KYC, and cross-border flows.

- Decide: Are tokens purely a loyalty construct, or quasi-monetary? Where can they be redeemed for cash, if at all?

- Stable value, not volatility

- Customers should never feel like their points are “trading.”

- Peg tokens to a predictable value (e.g., 100 points = 1 unit of fiat-equivalent) and keep pricing rules transparent.

- Ledger & infrastructure choices

- Permissioned blockchain vs tokenized internal ledger.

- Single-bank vs multi-bank consortium vs scheme-led rails.

- Integration into core banking, card systems, and POS networks.

- FX & cross-border settlement logic

- Who bears FX risk and how is it priced into token redemption?

- How are merchants settled in their local currency while loyalty value is managed centrally?

- Customer experience

- Simple, intuitive UX: “You have 12,500 points. Use 5,000 to save SGD 20 today?”

- Clear visibility of:

- Earn history

- Redemption history

- Value in different currencies / countries

If customers need a whitepaper to understand how to use points, the design has failed.

What’s the practical starting point?

For most banks, the journey doesn’t need to start with a big-bang replacement.

A realistic roadmap could be:

- Phase 1: Tokenize existing points “behind the scenes”

- Move from batch-based points ledgers to a token-based ledger.

- No customer change yet, but you get real-time visibility, better accounting, and a modern foundation.

- Phase 2: Introduce pay-with-points at POS in home market

- Start with a few strategic merchants.

- Let customers part-pay with points through existing cards or app-based QR.

- Phase 3: Extend cross-border & partner network

- Partner with regional merchants, travel companies, and marketplaces.

- Support redemption in 1–2 additional markets with clear governance and FX rules.

- Phase 4: Consortium or scheme-level collaboration

- Explore multi-bank or card-scheme led rails that standardize token specs and acceptance.

- This is where network effects and serious scale kick in.

Closing thought

Banks have been sitting on billions in unspent loyalty value.

Crypto and tokenization are not about turning banks into exchanges.

They’re about finally making loyalty live up to the promise of being “as good as cash” – usable, portable, and relevant in the moment of payment, across borders and channels.The institutions that move first will not just have a “cool loyalty program.”

They’ll own the rails on which the next decade of programmable rewards and everyday digital value will run. -

The Quiet Achiever’s Guide to Landing a CXO Role

Let’s be honest: most CXO job descriptions are missing a key requirement. They list leadership and strategy, but they rarely mention the unspoken rule—that these roles are often filled through networks, not online applications.

If the thought of “working a room” makes you want to hide in the bathroom, you’re not alone. The good news? You don’t have to become a charismatic schmoozer to get there. You just need to play a different, quieter game.

Your game is the long game, and it’s surprisingly powerful.

1. Think Turtle, Not Hare

Forget the idea of networking as a transaction. You’re not dropping a coin into a vending machine and expecting a job to pop out.

This is about compound interest. Tiny, consistent actions—a comment here, a shared article there—build up silently. One day, you’ll look up and realize you’ve built real momentum.2. Small Steps Beat Grand Gestures

You don’t need to make a big, awkward speech. The magic is in the micro-connections.

- Seen a post you liked? Leave a genuine comment.

- Read an article that reminded you of someone? Hit forward.

- Appreciate someone’s work? Send a two-sentence note saying so.

These small acts feel authentic, not forced, and they keep you on people’s radar without the ick factor.

3. Let Your Work Do the Talking

At the CXO level, charm is overrated. Credibility is everything.

Focus on building a reputation as someone who knows their stuff. Share your hard-won insights, mentor someone junior, or talk about a project you’re proud of. Your track record and trustworthiness are your greatest networking assets.4. Go for Depth, Not Width

Trying to connect with everyone is exhausting and ineffective. Instead, be a strategist.

Pick a handful of people (say, 10-15) in your field whose work you genuinely admire. Follow their journey. Engage with their ideas when you have something real to say. Consistent, thoughtful attention to a few is far more powerful than scattered outreach to hundreds.5. Be a Gardener, Not a Hunter

The best time to plant a tree was 20 years ago. The second-best time is now.

Start building connections before you need them. Offer a helpful introduction, share a relevant insight, or cheer on a peer’s success. People remember who was there when there was nothing obvious to gain.6. Build Your Own Gravity

Instead of chasing after people, create a space that pulls them in.

- Share a short, sharp lesson you learned from a mistake.

- Write down a framework that worked for your team.

- Post a real story about a leadership challenge.

When you share valuable ideas, you don’t have to find people—they find you. This is the quiet person’s superpower.

7. Embrace Your Slow-Brew Advantage

If you’re not a natural networker, your secret weapon is patience. Your relationships might take longer to build, but they’ll be rooted in genuine respect and shared value. When a top-level role opens up, that depth of connection matters far more than a thousand superficial LinkedIn contacts.

-

The Next Phase of Merchant Acceptance: From Physical Terminals to Programmable APIs

For decades, the payment terminal defined commerce. A physical box, a familiar beep, a printed receipt. But commerce has evolved. It now lives in mobile apps, social media, and connected devices. The very definition of “merchant acceptance” is being rewritten.

The future isn’t about installing hardware; it’s about activating an ecosystem through APIs.

From Hardware to Hyper-Connected Experiences

The old model was hardware-centric: set up a terminal and process transactions. The new model is software-driven and experience-led. Modern businesses—from global platforms to solo entrepreneurs—demand payments that are:

- Frictionless: A one-click buy button in a mobile app.

- Contextual: Paying for a ride within a ride-hailing chatbot.

- Embedded: Seamless checkout inside a game or on a smart device.

This shift is powered by APIs (Application Programming Interfaces), the invisible rails of modern finance. They don’t just move money; they connect payments to loyalty programs, identity verification, and real-time data analytics, creating unparalleled value.

The Rise of the Merchant-as-a-Platform

The biggest change is structural. Today’s merchants are often platforms themselves—hosting thousands of sellers, franchisees, and service providers.

To serve them, payment providers must evolve. The simple acquirer-merchant relationship is no longer enough. The new imperative is ecosystem orchestration, delivering modular APIs for:

- Instant Onboarding of new users and sub-merchants.

- Dynamic Payouts and sophisticated treasury management.

- Data-Driven Insights that inform business strategy.

- Embedded Credit and financial services.

In this new world, acceptance is programmable. The terminal is no longer a device; it’s a line of code.

What’s Next? Winning in the API Economy

The leaders in the next decade will be those who master three pillars:

- Interoperability: APIs that work seamlessly across any platform, channel, or region.

- Trust & Security: Building robust, compliant systems that protect every transaction.

- Data Intelligence: Leveraging payment data to power personalization, fraud prevention, and business growth.

We will see the convergence of payments, loyalty, and digital identity into single, powerful API frameworks.

The critical question for every business is no longer “How do we accept payments?” but “How do we accept opportunity?”

How are you embedding payments into your customer experience? Let’s discuss in the comments.

#Fintech #DigitalPayments #APIs #EmbeddedFinance #PaymentOrchestration #DigitalTransformation #Commerce #Innovation #Asia #APAC #LinkedInNewsAsia

-

The APAC Payments Puzzle: Stitching Together a Fragmented Landscape

If you’re building, selling, or moving money in Asia-Pacific, you know the feeling. The payments stack has never been more powerful, yet the experience has never felt more… patchwork.

We’ve built towering skyscrapers of financial technology, but they’re connected by rickety rope bridges. The incumbents? They own the foundations—unbeatable on coverage and compliance. But value is leaking from the seams between them: in clunky cross-border journeys, in data trapped in silos, in loyalty programs that frustrate more than they delight.

This isn’t just a problem. It’s an opportunity. But for a new player, the only way in is not with a bigger hammer, but with a smarter needle and the right thread.

Act I: The Lay of the Land – A Kingdom of Powerful, Isolated Castles

Picture the APAC payments landscape not as a single stack, but as a continent of formidable, walled cities.

- The Gateways & Acquirers are the well-maintained main roads in mature markets. They’re reliable, but the real battle for supremacy is now in the alleys and side streets—the quality of local payment methods, the speed of settlement, the strength of tokenization.

- The PayFacs are the express lanes, getting merchants to market at lightning speed. But the toll booth—onboarding and risk—is still manned by humans in too many places, creating frustrating bottlenecks for SMEs.

- The Orchestrators are the air traffic control towers. They’re brilliant at routing payments between different providers, but most only track the “planes” (transactions). Few have a unified view of the “weather” (fraud), the “passenger loyalty” (offers), and the “airport security” (identity).

- Loyalty & Campaigns are the bustling, disconnected marketplaces. Issuers, merchants, and wallets all run their own bazaars with different currencies. The experience of cashing in your loyalty points at a physical store versus an app is a roll of the dice.

The kingdoms are powerful, but they don’t talk to each other. And in the gaps between them, merchant and customer frustration grows.

Act II: The Pain Points – Where the Cracks Become Canyons

This fragmentation isn’t just an architectural debate; it’s a daily operational headache. It shows up as:

- A cross-border payment that feels anything but seamless for the merchant and the end-user.

- A small business owner waiting days for underwriting when alternative data could grant them instant, safe access to capital.

- A marketing team unable to tie a coupon redemption to a purchase history, missing the chance to create a truly valuable customer moment.

- A CFO squinting at a statement, unable to decipher the true cost-to-accept or the ROI on their value-added services.

The market isn’t asking for another pretty dashboard. It’s asking for a translator, a connector, a unifier.

Act III: The Blueprint – Becoming the Region’s Master Weaver

So, is there room for a new player? Absolutely. But the winning profile isn’t “another PSP.” It’s a Sidecar Growth Layer.

Imagine a platform that doesn’t try to rip and replace the existing rails but sits gracefully on top of them. It weaves them together with a single, intelligent rules engine that orchestrates not just payments, but also loyalty, installments, and identity. It makes the entire financial ecosystem smarter, not just faster.

The Wedges to Force Entry:

- The Bank’s New Arm: Become a Bank-Partnered PayFac. Offer banks and large merchants instant onboarding, sophisticated fraud controls, and funds management as a service. Share the economics; respect their balance sheet and compliance legacy.

- The Vertical Visionary: Pick a complex industry—like travel, healthcare, or marketplaces—and build its Operating System. Ship payments, financing, and loyalty as one seamless kit that solves the whole workflow, not just the transaction.

- The Borderless Bridge: Create a Cross-border Commerce Fabric that makes international payments feel domestic. Use smart local-method routing and transparent FX, and price your value on the uplift you create, not just the volume you process.

The Table Stakes: Without these, you don’t even get a seat at the table in Singapore or Sydney: impeccable security (PCI L1, ISO 27001), proactive regulatory alignment (MAS, etc.), and crystal-clear data governance.

Act IV: The Journey – A Map, Not a Mandate

You can’t conquer APAC all at once. You must respect its intricate tapestry of maturity.

- Stage 1 (Singapore, India): The Sophisticates

- The Play: Lead with hard numbers. Your “sidecar” must prove in a 60-90 day pilot that it lifts authorization rates and slashes costs. Partner with banks for credibility and win a lighthouse enterprise to build your case study. Sell quantified uplift.

- Stage 2 (Malaysia, Thailand, Australia): The Pragmatists

- The Play: Bundle a “PayFac-lite” offering with instant onboarding, and tie it to a loyalty wallet that works everywhere. Land a flagship partnership with a bank and a major retailer. Price with a clear, undeniable ROI model.

- Stage 3 (Indonesia, Philippines): The Builders

- The Play: Lead with your Vertical OS. Solve the entire messy flow for a marketplace or a telco—KYC, escrow, payouts, loyalty. Assemble a field-integration team to handle the last-mile work with local PSPs and wallets. Earn trust by solving acute pain.

The Final Word: The Invitation

APAC doesn’t crown the loudest player. It rewards the most thoughtful operator—the one who respects local rails, fixes the day-to-day pains, and makes everyone else in the value chain look good.

Be the quiet layer that improves outcomes for acquirers, banks, and merchants alike. If you can show a CFO a chart that goes up and to the right within the first quarter, you won’t just win a contract.

You’ll get invited to the Christmas party. And in APAC, that’s when you know you’ve truly arrived.

-

Building the Bridges of Digital Commerce — Why Access Matters as Much as Innovation

Every payment today feels instant. Tap, scan, or click — it just works. But behind that “instant” lies a complex web of gateways, APIs, and partnerships that quietly keep global commerce running. And that’s where the real magic — and challenge — happens.

The Hidden Infrastructure of Growth

When people talk about “innovation” in payments, they often picture shiny new apps or sleek cards. But innovation rarely happens in isolation. It happens in connection — between banks, merchants, processors, and platforms. The unsung heroes are the access and gateway layers that make every payment flow possible, whether it’s a QR in Bangkok, an A2A transfer in Jakarta, or a tokenized checkout in Tokyo.

Having spent years working with issuers, merchants, wallets, and acquirers across APAC, I’ve seen how access defines opportunity. A market’s readiness to adopt new rails isn’t just about technology — it’s about orchestration. Aligning the pipes, partners, and products that turn potential into scale.

From Pipes to Partnerships

The next wave of digital commerce won’t be about who owns the rails. It’ll be about who orchestrates the connections. The future belongs to the networks and platforms that can seamlessly bridge closed and open loops, combine loyalty with payments, and deliver secure, intelligent access to every ecosystem — cards, wallets, and account-to-account flows alike.

That’s why I’m particularly drawn to roles that look beyond transactions — toward platform-level orchestration. The opportunity to help merchants, banks, and fintechs unlock new value through smarter routing, better APIs, and data-driven engagement is where the real growth frontier lies.

Leadership Beyond the Technical

In a region as diverse as Asia Pacific, scaling a payments business isn’t about one-size-fits-all strategy. It’s about empathy, context, and collaboration. Leading cross-market teams from Singapore to Manila to Hong Kong has taught me that technology may connect systems, but leadership connects people.

Building trust across cultures, aligning local priorities with regional goals, and fostering innovation without chaos — that’s the part of the job I enjoy most. Because a truly resilient payments ecosystem isn’t built by code alone; it’s built by people who understand both the tech and the trust behind it.

Why Access Is the New Advantage

Access and gateways might sound like back-end plumbing, but they’re actually the front line of financial inclusion and digital transformation. They decide who gets to play, how fast new products launch, and how seamlessly value moves between ecosystems.

As I look at where the industry is heading — embedded finance, real-time payments, open banking — it’s clear that access is becoming the new advantage. Those who can simplify connectivity while scaling securely will define the next decade of digital commerce.

-

Payments in APAC: A Crowded Dance Floor, But Who Controls the Music?

Across the Asia-Pacific region, a universal scene unfolds at the checkout counter: a mosaic of QR codes, a battle for prime real estate on smartphone screens, and the rapid adoption of domestic real-time payment rails. It resembles a crowded party where every player is vying to control the music.

The critical question remains: who is the true host, and which players will endure when the tempo inevitably shifts?

Two Distinct Neighborhoods Within One Region

While geographically adjacent, Southeast Asia and North Asia represent fundamentally different paradigms in the payments landscape.

Southeast Asia: The Innovation Laboratory

Southeast Asia serves as a dynamic proving ground. The region is simultaneously experimenting with every available payment rail—QR codes, digital wallets, super-apps, and domestic account-to-account (A2A) infrastructure. Merchant acquisition is a fiercely competitive arena characterized by:- Government-led initiatives promoting zero-MDR QR code acceptance.

- Wallet providers engaging in aggressive cashback wars to subsidize user acquisition.

- Super-apps leveraging payments as a core feature within bundled ecosystems like food delivery, ride-hailing, and e-commerce.

The environment is fragmented and intensely competitive, yet it boasts undeniable growth. For many consumers, digital wallets are the gateway to financial services. For merchants, the choice often boils down to whichever solution delivers customers at the lowest cost.

North Asia: The Established Boardroom

In stark contrast, North Asia (Japan, South Korea, Taiwan, Hong Kong) operates with the maturity of established markets where card-based payments are deeply entrenched. The landscape is orderly, structured, and driven by loyalty. While digital wallets exist, they typically operate on top of existing card networks. Consumer preference is less about payment method availability and more about the value of the loyalty ecosystem—be it credit card rewards, retail partnerships, or co-branded benefits.Innovation here focuses on refinement:

- Sophisticated Installment Plans: Such as Japan’s long-standing affinity for “3-pay” card installments.

- Integrated Loyalty Platforms: Connecting transit, retail, and dining into seamless reward systems.

- Advanced Regulation & Consumer Protections: Enhancing trust in mature financial systems.

In essence, one region is still constructing the foundational infrastructure, while the other is focused on enhancing the consumer experience atop a stable base.

The Global Schemes: A Quiet, Enduring Influence

Amid the buzz surrounding local champions like UPI, PIX, and PromptPay, it is premature to relegate global payment networks like Visa, Mastercard, and UnionPay to the past. Their enduring relevance stems from three key strengths:

- Global Trust & Interoperability: They provide a trusted, reliable backbone for cross-border commerce.

- Strategic Embeddedness: They are increasingly integrating with local wallets and fostering interoperability between disparate QR code systems.

- Focus on New Frontiers: They are strategically pivoting towards complex, high-value areas like B2B flows, SME financing, and card-based installments—spaces where domestic rails are less effective.

The music may have changed, but the global schemes continue to own and operate the critical sound system.

The Strategic, Not Just Technological, Rise of A2A

The dominance of A2A rails like India’s UPI or Brazil’s PIX is often misattributed to superior technology alone. In reality, they are frequently geostrategic projects. Driven by central banks seeking cheaper, sovereign payment infrastructure, their adoption is accelerated by merchants eager to escape the higher costs of card acceptance.

India’s UPI, with its near-zero Merchant Discount Rate (MDR), became an obvious choice for merchants, and government backing made widespread adoption a certainty. This is a top-down model of success. While organic, bottom-up models like Poland’s BLIK exist, they are the exception.

The narrative is not simply “cards vs. A2A.” It is a functional division of labor. Card networks maintain strength in brick-and-mortar retail for their predictability and global reach, while e-commerce is rapidly tilting towards lower-cost A2A options. As digitization deepens, this tilt will only become more pronounced.

The Next Frontier: When Payment Rails Become Intelligent

Once payment rails become commoditized, competition shifts from cost to intelligence. This is the domain of Artificial Intelligence.

- Strategic Merchant Growth: AI can identify high-potential merchants, predict churn, and determine the optimal timing for upselling loyalty or lending products.

- Dynamic Fraud Defense: Static rule-based systems are obsolete. AI excels at real-time anomaly detection across QR, card, and wallet transactions.

- Smart Transaction Routing: An AI-powered orchestration layer can dynamically select the optimal payment rail at the point of sale—balancing cost, speed, and reward value for a competitive edge.

- Personalized Engagement: Clunky loyalty programs can be transformed into seamless, personalized lifestyle experiences through AI-driven insights.

AI will not build the rails, but it will decisively determine which ones thrive.

The Merchant’s Strategic Calculus

Merchants are active architects of this evolution. While cost is paramount—favoring A2A and QR solutions—it is balanced against the need for reliability, speed, and catering to consumer preference.

- Large Retailers value the predictability and global interoperability of card networks.

- SMBs favor the simplicity and low fees of wallets and QR-based systems.

- E-commerce Players, operating on thin margins, are increasingly driven towards the cost efficiency of A2A payments.

The collective voice of merchants will ultimately dictate the winning rails in each market.

The Road Ahead

The APAC payments landscape is not slowing down; it is accelerating in its complexity.

- Southeast Asia will continue its dynamic, multi-rail experimentation.

- North Asia will deepen the sophistication of its mature, loyalty-driven ecosystems.

- Global schemes will embed themselves further into local fabrics and dominate the complex B2B payments space.

- AI will emerge as the invisible hand, shaping outcomes in fraud prevention, merchant strategy, and transaction routing.

In a room this crowded, success is no longer about who shouts the loudest. It is about providing the intelligence that everyone relies on. And increasingly, that authoritative voice will belong to AI.

-

Rethinking Loyalty: From Checkout Points to Preventive Healthcare

The Rising Challenge of Healthcare Costs

Globally, healthcare systems are under strain. Populations are living longer, chronic illnesses are more prevalent, and governments face growing pressure to keep healthcare affordable while maintaining high standards of care. Subsidies, insurance payouts, and public expenditure continue to rise year after year.

Taiwan, with its world-renowned National Health Insurance (NHI) system, is often celebrated as a model of efficiency and accessibility. Yet even here, the twin challenges of an aging population and increased demand for long-term care present a looming financial burden. The central question is simple: how do we ensure sustainability without compromising citizen well-being?

One answer lies in looking outside traditional healthcare models—borrowing a page from an industry that has spent decades perfecting engagement: loyalty programs.

Loyalty Beyond Retail

Loyalty programs are typically associated with airlines, supermarkets, and shopping malls. Customers earn points for purchases, redeem them for discounts, and engage in campaigns that drive repeat behavior. What if the same mechanics could be applied to healthcare, not for buying more, but for living better?

Instead of rewarding consumers for spending money, imagine a system that rewards citizens for preventive care: completing annual check-ups, attending wellness screenings, adhering to prescribed treatments, or even engaging in fitness challenges. The result is a healthcare loyalty ecosystem that drives proactive, healthy behaviors at scale.

The Healthcare Loyalty Ecosystem

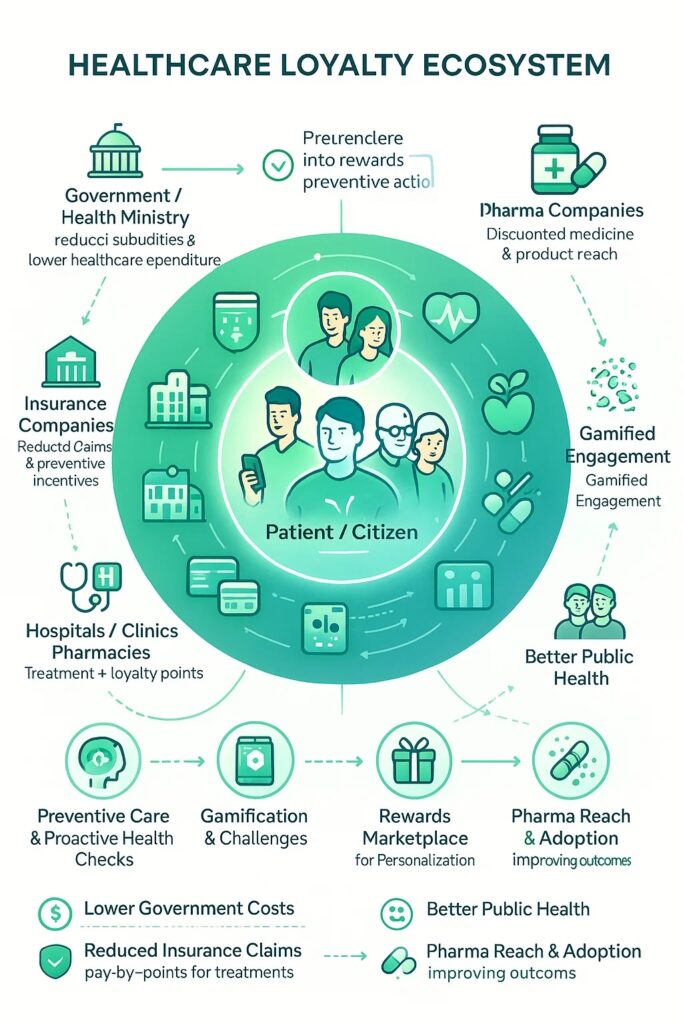

At the center of this model is the citizen. Surrounding them are the key stakeholders:

- Government & Policy Makers: redirecting subsidies toward preventive incentives, lowering long-term costs.

- Insurance Companies: reducing claims by encouraging risk management and early detection.

- Pharma Companies: engaging citizens through affordable medicine bundles, discounts, and trial programs.

- Hospitals, Clinics, and Pharmacies: becoming partners in proactive health rather than only reactive care.

- Banks & Payment Providers: enabling installment options and pay-by-points for treatments and prescriptions.

Connecting them is a loyalty engine that orchestrates earn-and-burn mechanics, gamified challenges, rewards catalogues, and AI-powered personalization.

How It Works

- Earning Points Through Preventive Actions

- Annual health check-ups, screenings, vaccinations, and wellness programs all generate loyalty points.

- Fitness and lifestyle apps integrate to reward daily healthy habits—steps walked, sleep tracked, or nutrition logged.

- Redeeming Points for Value

- Citizens can redeem points at pharmacies for discounted medicines or supplements.

- Clinics and hospitals allow points to cover part of co-payments or elective services.

- A central rewards catalogue offers wellness products, healthy meal kits, or even fitness classes.

- Government Benefits

- By incentivizing preventive care, the government reduces long-term spending on late-stage treatments.

- Subsidies are used more efficiently—supporting citizens before illness escalates into high-cost interventions.

- Insurance Benefits

- Fewer claims are filed as more conditions are caught early.

- Insurers can offer lower premiums or bonus coverage tiers tied to healthy behaviors.

- Pharma Benefits

- Discounted pricing increases accessibility and volume without undermining margins.

- Engagement channels with patients expand, creating stronger brand loyalty.

- Citizen Benefits

- A gamified, engaging program makes healthcare feel rewarding rather than punitive.

- From Gen Z tracking fitness on wearables to elderly citizens encouraged into screenings, all demographics are included.

Gamification as a Public Health Driver

Traditional health campaigns often struggle with engagement. Posters, pamphlets, and public service announcements may raise awareness but rarely change long-term behavior. Gamification changes this dynamic.

Imagine national health challenges where citizens compete or collaborate for collective rewards. A city could run a “10,000 Steps Challenge” where participants earn both personal points and contribute to community-wide benefits. A family could unlock bonus points for completing annual dental or vision check-ups together.

Gamification taps into intrinsic motivators—competition, achievement, and recognition—while aligning them with extrinsic rewards like discounts and perks.

AI and Personalization

A critical part of making such a system effective is personalization. Not every citizen has the same needs, risks, or motivations. AI-driven insights can ensure the program is not “one-size-fits-all”:

- Seniors might receive prompts for screenings or chronic condition management.

- Young adults could be nudged toward fitness and nutrition challenges.

- Families could be encouraged to engage in multi-generational wellness plans.

Personalization not only improves effectiveness but also ensures citizens feel supported rather than managed.

Economic and Social Impact

The benefits of a healthcare loyalty ecosystem extend well beyond individual wellness.

- For governments, this model means controlling costs by shifting from treatment to prevention.

- For insurers, it offers a healthier risk pool and better profitability.

- For pharma, it enables more targeted engagement and steady demand.

- For citizens, it builds healthier, longer lives with greater access and affordability.

The broader societal impact is immense: a healthier, more productive population, reduced financial stress on families, and a healthcare system designed for sustainability.

Why Now?

The convergence of digital health tools, payment innovations, and AI-powered personalization makes this model achievable today in ways that were not possible a decade ago. Citizens already engage with loyalty in retail, airlines, and e-commerce. Extending the same principles into healthcare is not a leap—it’s a natural evolution.

For a country like Taiwan, with its strong digital infrastructure and a culture that values collective well-being, the opportunity to pilot such a model is significant. It could serve as a blueprint not only for Asia but for the world.

A Call to Action

Healthcare loyalty is not about gamifying sickness—it’s about rewarding wellness. It’s a chance to create an ecosystem where every stakeholder benefits and where citizens feel empowered to take charge of their health.

By rethinking loyalty, we can shift from a system that pays for treatment to one that rewards prevention. The impact could be nothing short of transformative—for governments, businesses, and, most importantly, the people.

-

The Power Combo: Emotional Intelligence and Situational Leadership

Let me let you in on a little secret: the best leaders I’ve coached—CEOs of global giants, stewards of billion-dollar empires, and yes, even that brilliant but chaotic founder with a penchant for 3 a.m. emails—all share two things in common: they master their emotions, and they tailor their leadership style like a well-fitted bespoke suit.

In other words: Emotional Intelligence (EQ) plus Situational Leadership equals Next-Level Leadership. Let’s unpack that combo.

First, What is Emotional Intelligence Really?

EQ is not about hugging your team after every meeting or bursting into tears during a quarterly review (though, hey, vulnerability does have its place). It’s about mastering five core traits:

- Self-awareness – You know when you’re triggered. You don’t let ego drive the bus.

- Self-regulation – You don’t hit “reply all” when you’re angry.

- Motivation – You’re driven by purpose, not perks.

- Empathy – You notice when a team member is struggling—and you ask why.

- Social skills – You know how to influence, not bulldoze.

EQ is what turns an intelligent leader into an impactful one. It’s what allows you to walk into a tense boardroom and lower the emotional temperature just by being you.

Now, Add Situational Leadership to the Mix

Let’s be clear: there’s no such thing as a one-size-fits-all leadership style. That’s like wearing flip-flops to a black-tie gala—it’s just not going to work.

Situational Leadership, made popular by Paul Hersey and Ken Blanchard, is the art of adapting your leadership style based on the readiness and maturity of the person you’re leading.

You choose your style depending on two factors:

- Task competence (Can they do it?)

- Commitment (Will they do it?)

Based on that, you move between:

- Directing – High direction, low support – for beginners.

- Coaching – High direction, high support – for learners with some experience.

- Supporting – Low direction, high support – for capable but hesitant individuals.

- Delegating – Low direction, low support – for stars who can run on their own.

Simple? Yes. Easy? Not always.

So, How Do EQ and Situational Leadership Work Together?

Let’s imagine this scenario:

You’ve got a high-performing team lead who’s just made a massive error in a client presentation. You’re frustrated—but you pause. You regulate your emotions (EQ), and then consider: is this a competence issue or a confidence issue?

You realize they’ve always performed well. So you support rather than scold. You coach them through the error, help them see how to bounce back, and they leave more confident, not crushed.

That’s the magic. You don’t react. You respond. And you respond in the right way for the right person at the right moment.

How to Build These Muscles (Without Meditating on a Mountain)

- Journal Your Reactions: End your day by jotting down one moment where your emotions almost hijacked your judgment. What could you have done differently?

- Practice Empathy Reps: Ask more “What’s going on for you?” and fewer “Why didn’t you do this?” questions.

- Do a Readiness Radar: Review your team. Where are they on the competence/commitment scale? Adjust your style accordingly.

- Seek Feedback Religiously: Not just from peers or bosses—ask your team. “What’s one thing I can do better as a leader?” is a powerful question.

Final Word: Leadership Isn’t About You. It Starts With You.

Emotional intelligence helps you manage your emotions. Situational leadership helps you manage others effectively. Together, they create a dynamic duo that can turn even a turbulent team into a championship one.

Remember, the goal isn’t to be a “great boss.” The goal is to be the kind of leader whose presence calms storms, lifts spirits, and multiplies impact—someone people don’t just follow because they have to, but because they want to.

So go ahead. Sharpen your EQ. Flex your leadership style. And most importantly—stay human.

-

Fintech Revolutionizing B2B Payments: The Role of Stablecoins

The B2B payments landscape is undergoing significant transformation driven by fintech innovations aimed at solving longstanding inefficiencies. Traditional B2B payment methods such as ACH, wire transfers, and SWIFT transactions are often cumbersome, slow, and costly, particularly when crossing borders. Fintech solutions are stepping in to address these pain points, delivering enhanced transparency, speed, and interoperability for businesses.

How Fintech Addresses B2B Payment Challenges:

1. Speed and Efficiency:

Fintech platforms optimize transaction processes through automation, API-driven integrations, and real-time payment rails. This significantly reduces delays associated with traditional methods like ACH or SWIFT. Companies benefit from improved cash flow management and faster reconciliation cycles.

2. Cost Reduction:

Cross-border transactions traditionally involve high fees and unfavorable exchange rates. Fintech companies leverage innovative models, including peer-to-peer matching and blockchain-enabled settlements, to minimize fees, reduce forex spreads, and lower the overall cost burden on businesses.

3. Enhanced Transparency:

Fintech solutions offer detailed tracking and reporting capabilities, enabling businesses to monitor payment status, FX rates, and compliance requirements seamlessly. Real-time dashboards and analytics provide visibility, enabling informed financial decisions and efficient treasury management.

Stablecoins: A Transformational Intermediary

Stablecoins—digital assets pegged to stable fiat currencies—are emerging as a powerful fintech innovation for streamlining B2B transactions, particularly in cross-border contexts. Here’s how the process typically works:

- The payer initiates payment in their local fiat currency.

- The fintech platform converts this fiat currency into a stablecoin.

- The stablecoin is transferred via blockchain networks rapidly and securely.

- Upon receipt, the stablecoin is automatically converted back into the recipient’s fiat currency.

This mechanism preserves fiat convenience at both ends of the transaction while harnessing blockchain’s benefits—speed, transparency, lower cost, and enhanced security.

Advantages of Using Stablecoins for B2B Payments:

- Reduced Settlement Time: Transactions settle in minutes or seconds compared to days for traditional cross-border transfers.

- Lower Transaction Fees: Stablecoins significantly cut intermediary fees and reduce FX volatility.

- Increased Liquidity and Accessibility: Businesses gain instant access to liquidity, enhancing working capital efficiency.

- Improved Traceability and Compliance: Blockchain-based stablecoin transactions provide transparent, immutable audit trails, simplifying compliance and regulatory reporting.

Real-World Applications and Future Potential:

Industries like manufacturing, logistics, e-commerce, and travel have already begun integrating fintech and stablecoin solutions to facilitate supplier payments, invoice settlements, and global payroll. Companies benefit through streamlined workflows, lower operational costs, and improved financial control.

Looking ahead, the adoption of stablecoins and fintech platforms will likely accelerate as businesses seek agility and competitive advantage in a globalized economy. Regulators and financial institutions are becoming increasingly supportive, recognizing stablecoins’ potential to modernize financial infrastructure while retaining robust governance and compliance frameworks.

In conclusion, fintech’s integration of stablecoins offers a compelling solution for transforming B2B payments, promising to redefine both local and international transaction standards.

Introduction